Advanced Payment Reconciliation Initial Setup

Advanced Payment Reconciliation is very quick to set up. You need to activate your trial and complete the Setup Wizard. This page takes you through these steps.

Set-by-Step Guide - Activating Theta Products

This guide will take you through the steps to activate your free trial for Theta products.

Setup Wizard

This wizard will assist you with setting number series, journal batch details, and bank journal source codes. The Advanced Payment Reconciliation includes additional bank statement references that can be updated when you import your bank statement. The wizard allows you to specify the field captions for these additional reference fields.

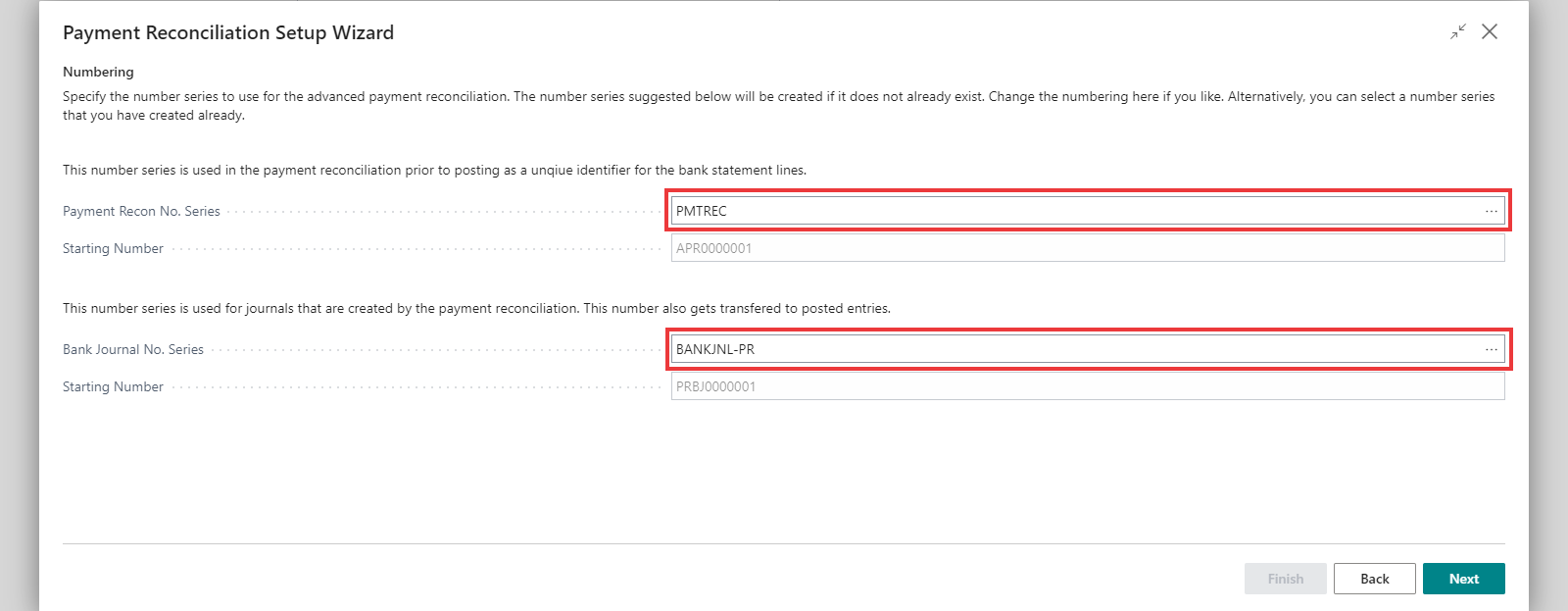

Step One: Specify Number Series

Here you can set the Payment Recon No. Series which allocates a new number for payment reconciliation worksheets, and Bank Journal No. Series which specifies the number series used in creating the journal after matching the bank statement lines. There are default number series provided for you to use.

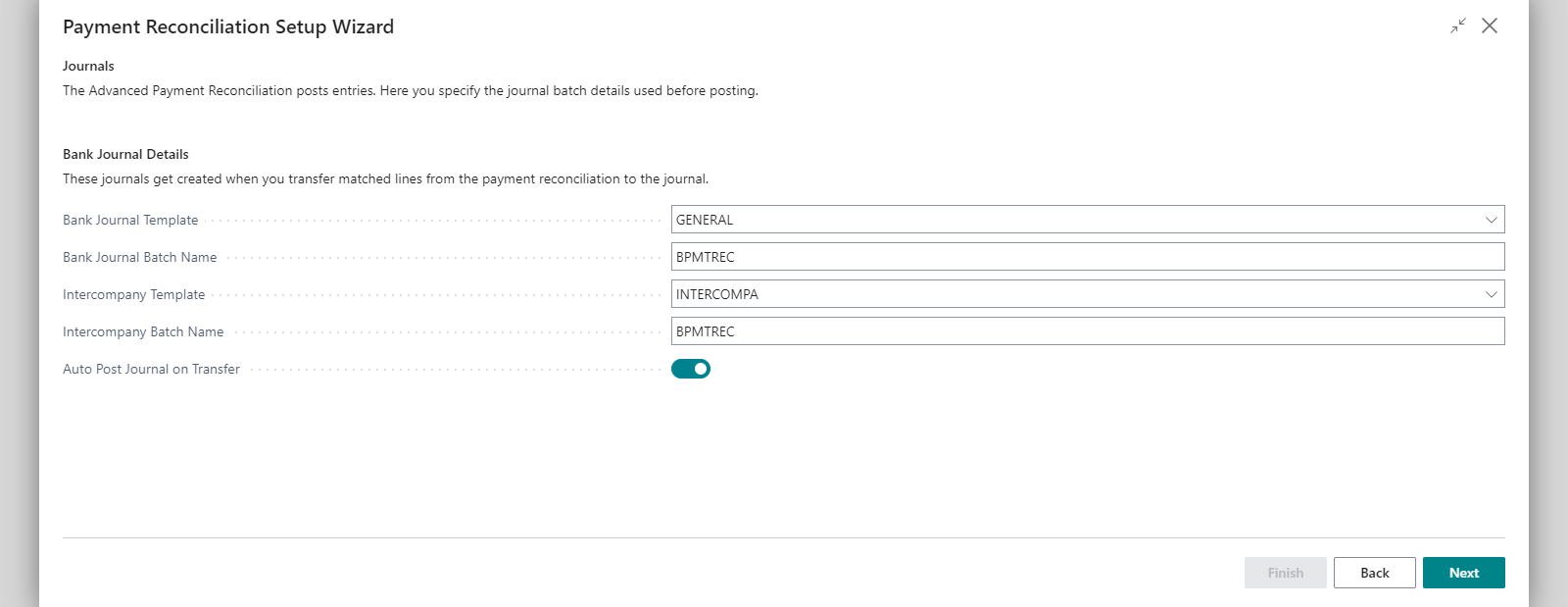

Step Two: Journal Batch Details

Here you can specify the bank journal details to use for posting. The bank journals are created when you transfer matched lines from the payment reconciliation to the journal.

Bank Journal Template is the journal template used for creating journal entries after matching the bank statement lines. This is normally GENERAL.

Bank Journal Batch Name is the journal batch name used for creating journal entries after matching the bank statement lines. BPMTREC is a new batch installed by the extension, but you can change it here.

Intercompany Template is the Intercompany Journal template name used for creating intercompany journal entries after matching the bank statement lines with an IC partner.

Intercompany Batch Name is the Intercompany Journal batch name used for creating intercompany journal entries after matching the bank statement lines with an IC partner.

If you enable Auto Post Journal on Transfer the system will automatically post the journal entries resulting from the payment reconciliation matching when you transfer the matched entries to journal. This can be adjusted on the Payment Reconciliation Setup.

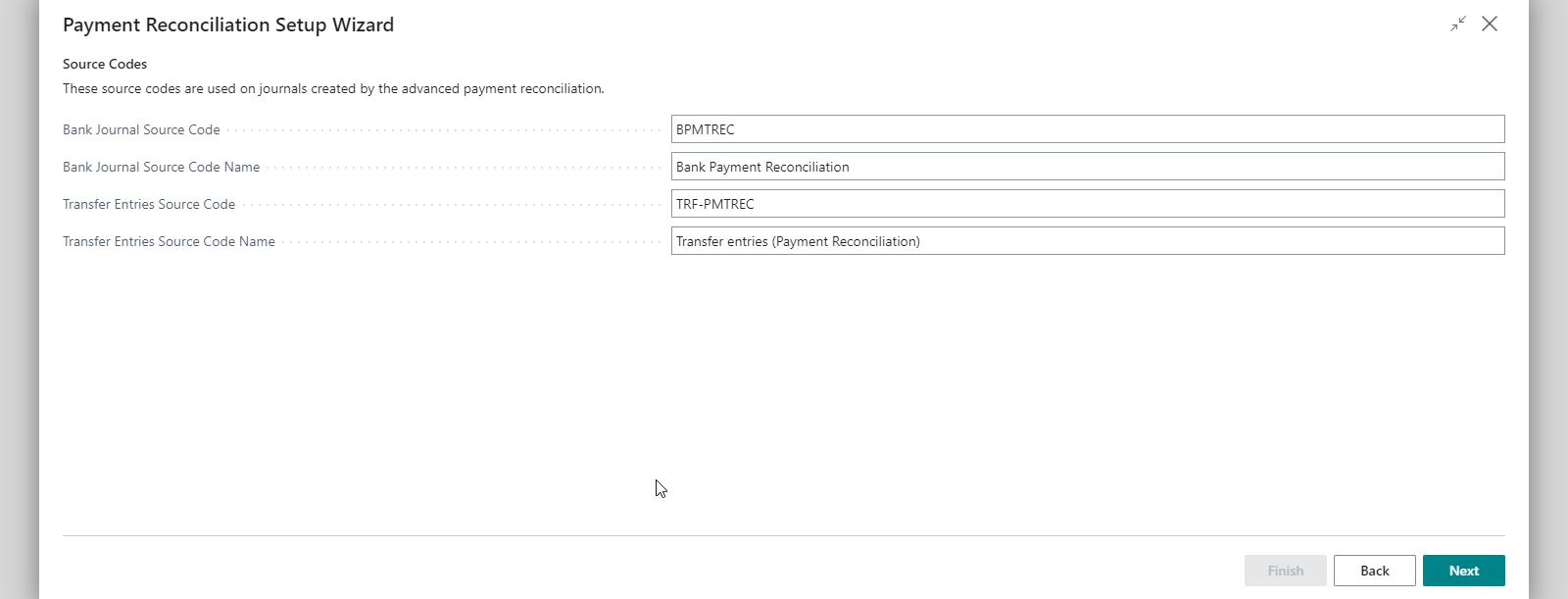

Step Three: Source Codes

The source codes specified are used on the journals created by the Advanced Payment Reconciliation.

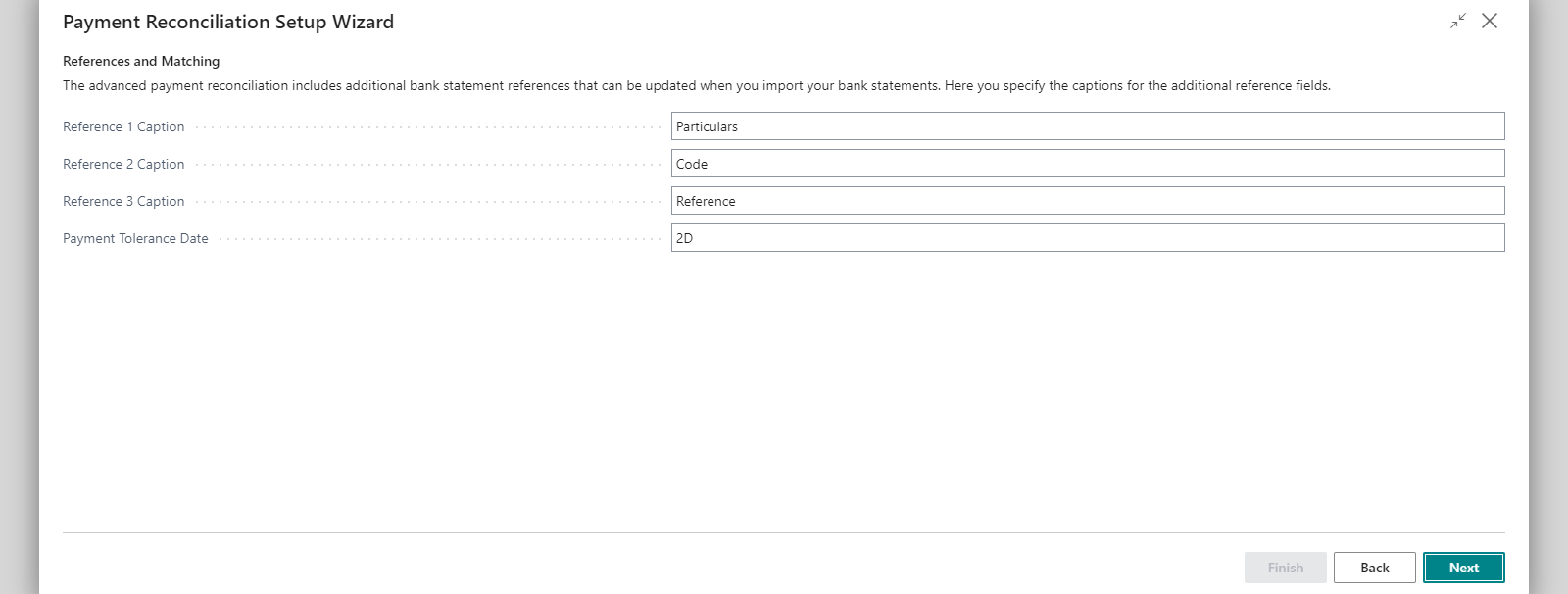

Step Four: References

Here you can specify the captions for the additional reference fields.

The common captions used for the additional reference fields are as follows:

- Reference 1 Caption is often Particulars.

- Reference 2 Caption is often Code.

- Reference 3 Caption is often Reference.

- Payment Tolerance date is commonly set to 2D (2 days).

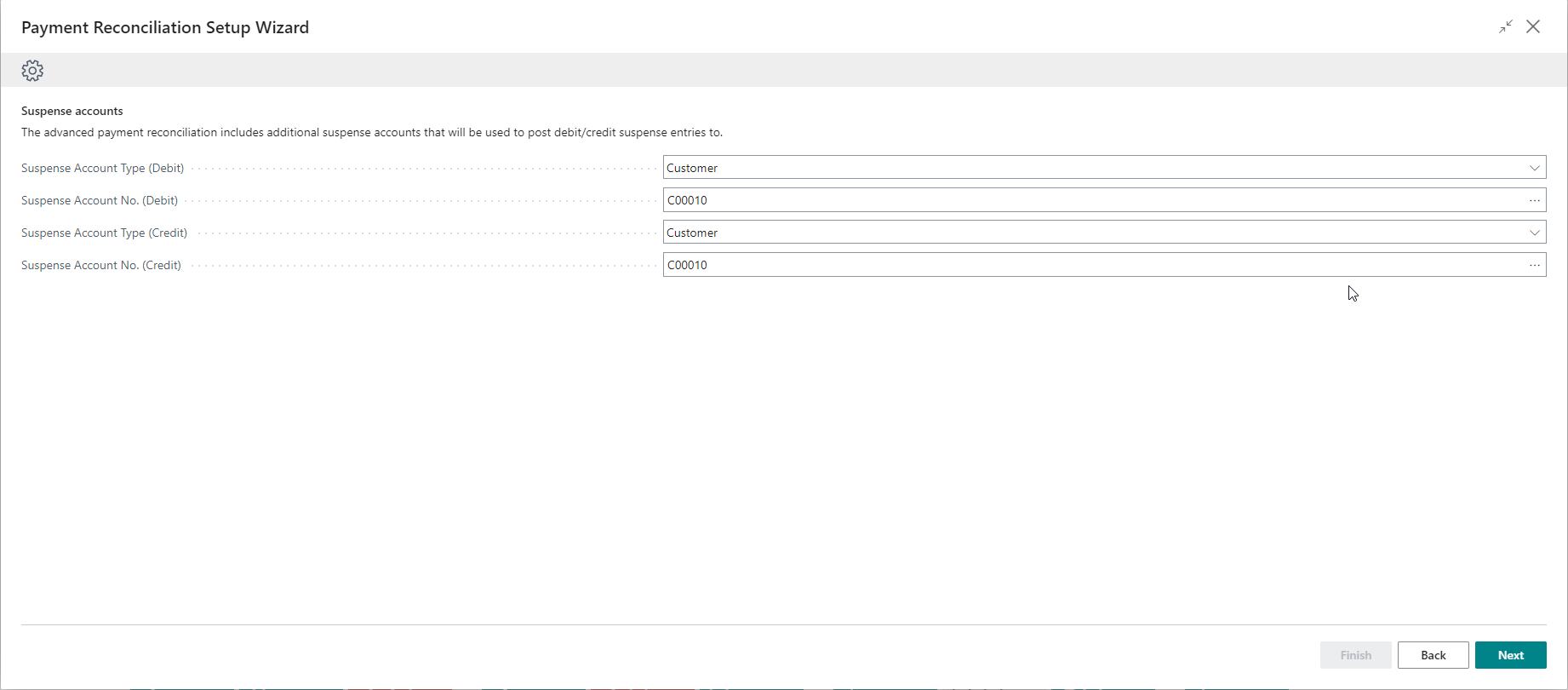

Step Five: Suspense Accounts

If you want to transfer unidentified receipts or payments to a suspense account, then you can select the suspense accounts to use here.

We suggest using a customer for the debit entries in the bank account as these are most likely receipts and should be decreasing your accounts receivable. Conversely, credit expenses relate to accounts payable or expenses, so you can use a vendor here. Since unidentified credits are less common, you may use the same suspense account for debits and credits. In our example, we created and used the same new customer for both.

- You can create a new customer posting group and map this to an account called Unidentified Deposits, giving you visibility in the General Ledger.

- You can skip setting up the suspense accounts or set them up later.

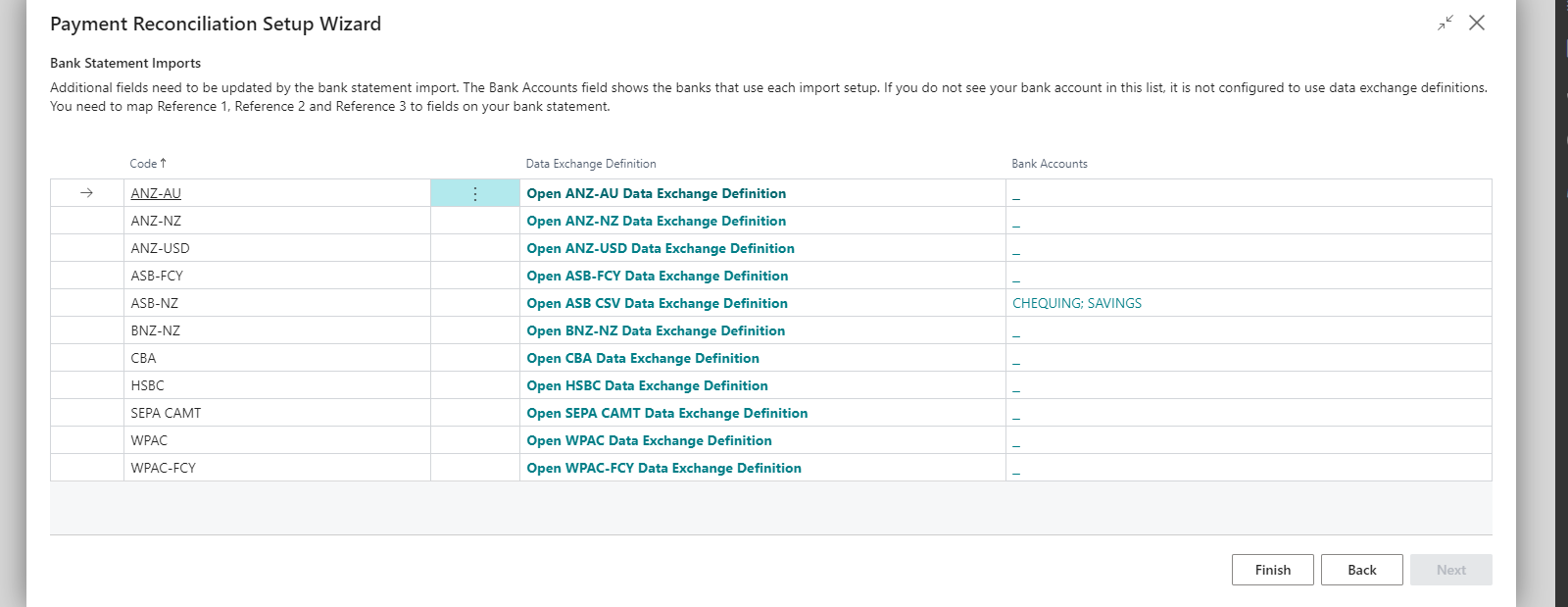

Step Six: Bank Statement Imports

If you do not see your bank account in the below list, it is not configured with a bank import export code. In the related Data Exchange Definitions you will need to map Reference 1, Reference 2 and Reference 3 to fields on your bank statement.

You can find more information on Data Exchange Definitions and Field Mappings below.

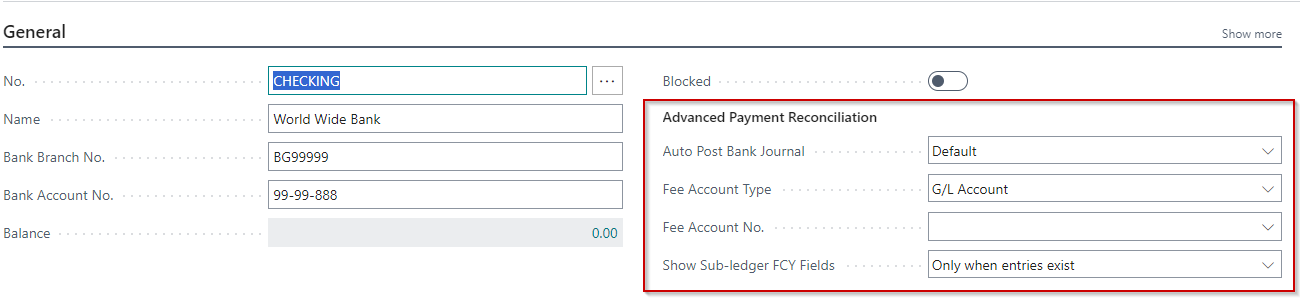

Bank Account Card Settings

The app adds new fields on the Bank Account Card:

- Auto Post Bank Journal is used to override the Auto Post Bank Journal rule defined in the Advanced Payment Reconciliation Setup. You only need to update this if this bank account should have a different setting from other bank accounts.

- Fee Account Type and Fee Account No. are used to specify the account where the transaction fee associated with the bank statement line should be posted. The scenarios where this is required include:

- To handle the fees the bank charges when you make payments in a foreign currency.

- To handle fees from a payment provider - for example - Stripe.

- Show Sub-ledger FCY Fields controls the visibility of the fields used to handle transactions in a different currency to the bank account currency. The default option is to show these fields only when you have a transaction line with a different currency to the bank account currency.

The Auto Post Bank Journal toggle on the Payment Reconciliation Setup must be enabled if you want automatic posting to be your default setting, regardless of whether it is set on the individual Bank Account card.

You can enable this toggle from step two of the Setup Wizard and can disable it any time on the Payment Reconciliation Setup.

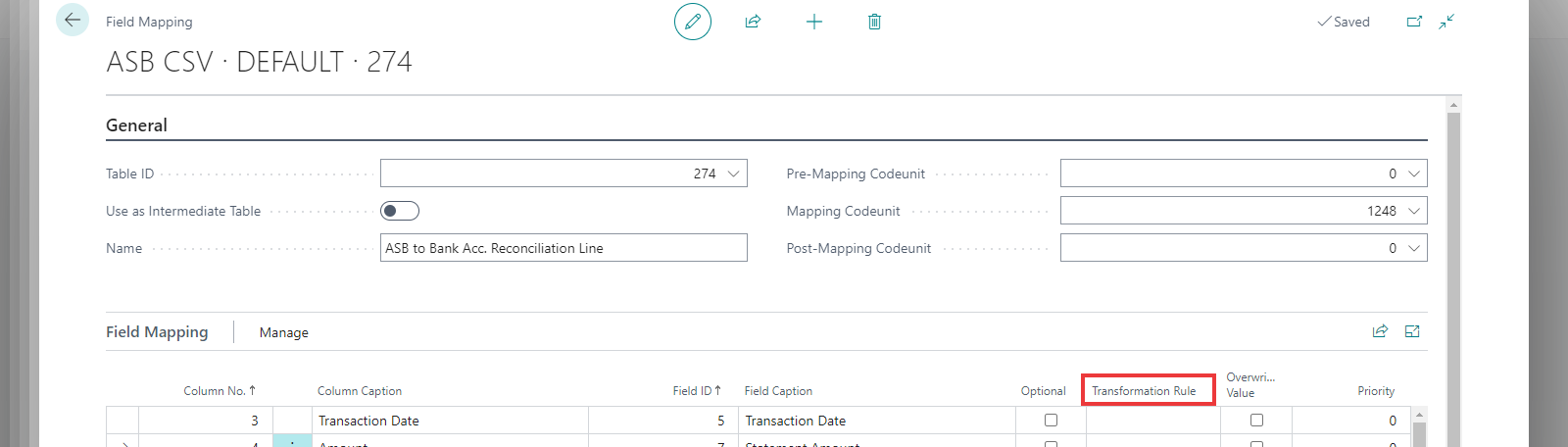

Field Mappings in the Data Exchange Definition Setup

If your bank includes columns for Particulars, Reference, or Code in their bank account statement files (as mentioned in step four of the Setup Wizard), these fields can be mapped against the related payment reconciliation fields within the system.

This mapping is completed within the Data Exchange Definition Setup. A detailed step-by-step guide can be found here.

Transformation Rules

On the Field Mapping page, you can set a transformation rule that can be used to reformat the column value using built in formatting functions.

Business Central provides a list of pre-configured transformation rules that can be utilised, otherwise new rules can be created. Transformation Rules can also be used in the Automatic Matching Rules. For Example, to correct a possible mistake on a Customer's payment references and apply it to Automatic Matching Rules.

If you choose to apply the transformation rule in the Data Exchange Definition field mapping, it will be applied on all of the statement lines.

You can choose to apply transformation rules only when matching the statement lines for more flexibility. For instance, if you want to convert the Code to UPPERCASE only when matched to a customer, transformation rule should not be applied here; it should be defined on the Matching Rules.

You can find more details on standard Business Central Data Exchange Definitions and Transformation Rules here.

- This guide will take you through the steps to complete the Setup Wizard, access the settings in the Bank Account Card, complete the field mappings in the Data Exchange Definition Setup, and set Transformation Rules.

- Matching Rules

- Standard Business Central Data Exchange Definitions and Transformation Rules