Processing

Importing the Bank Statement File

To process Advanced Payment Reconciliation, you will first need to import a bank statement file into a Bank Account Reconciliation.

You can import a bank statement file by following the below steps:

- Open the Bank Account Reconciliations list.

- Create a New Bank Account Reconciliation for your chosen bank account.

- Import a bank file through Import Bank Statement under Bank on the Navigation menu.

- Set the Statement Date in advance, or select Yes if prompted to accept a statement date.

You can find the full set of instructions on how to import a bank file here.

Running Automatic Matching in Payment Reconciliation

You can run the Automatic Match from the Payment Reconciliation page.

Follow the below steps:

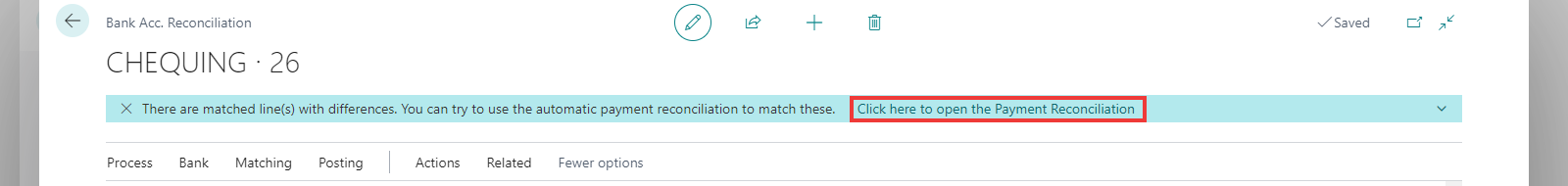

- From the Bank Acc. Reconciliation Card, select the message Click here to open the Payment Reconciliation.

You can also open the Payment Reconciliation by clicking Matching and then clicking Payment Reconciliation on the navigation menu.

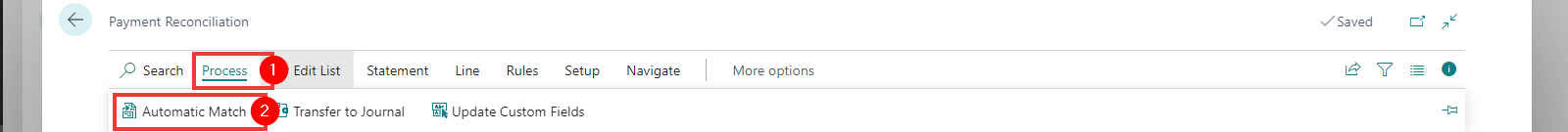

- On the Payment Reconciliation navigation menu, click Process and then click Automatic Match.

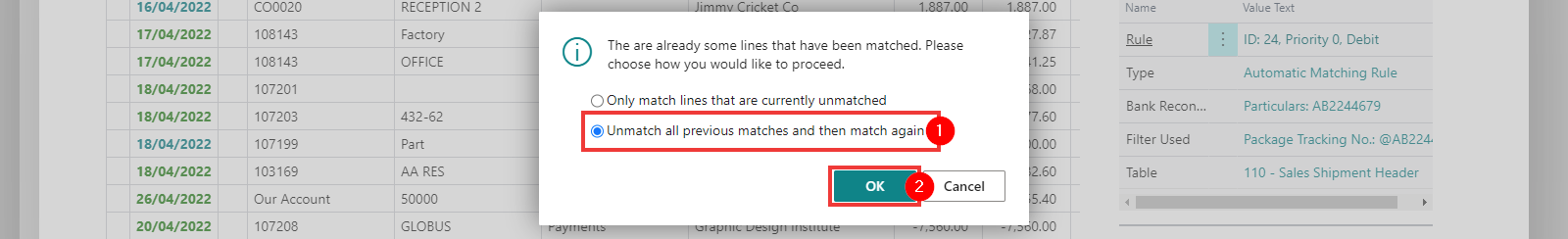

- Select Yes to run the Payment Reconciliation. If you have matched entries before you run the Automatic Match, you will receive the option to either only match the unmatched entries, or to remove all applications and run the match again. Select the desired option and then click OK.

If you have updated your Automatic Matching Rules and would like to see them applied, you should select Unmatch all previous matches and then match again. You can find more information here on Automatic Matching Rules.

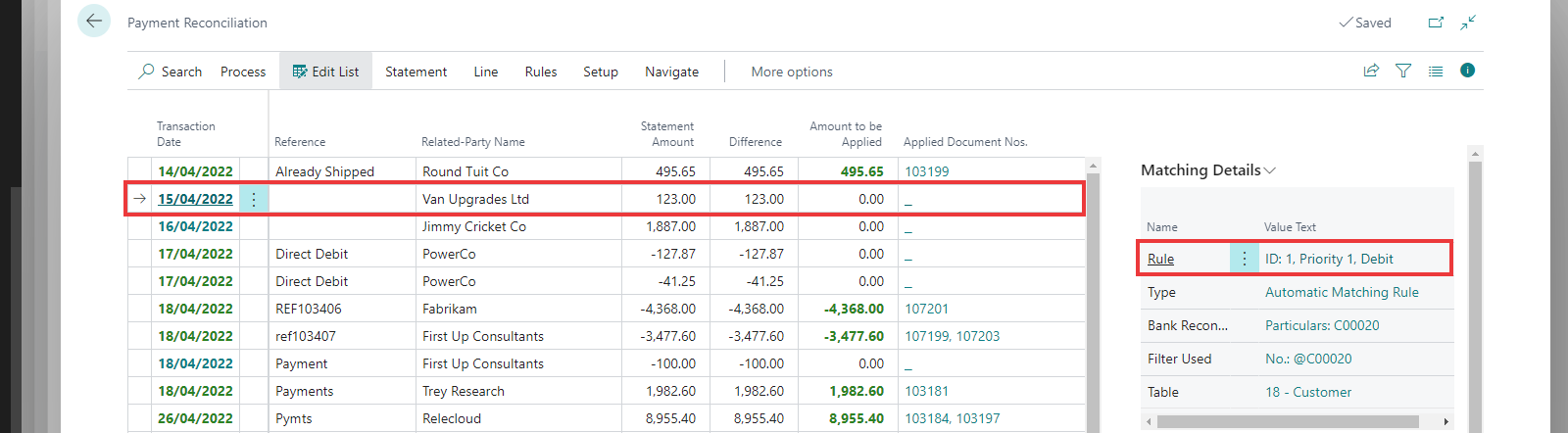

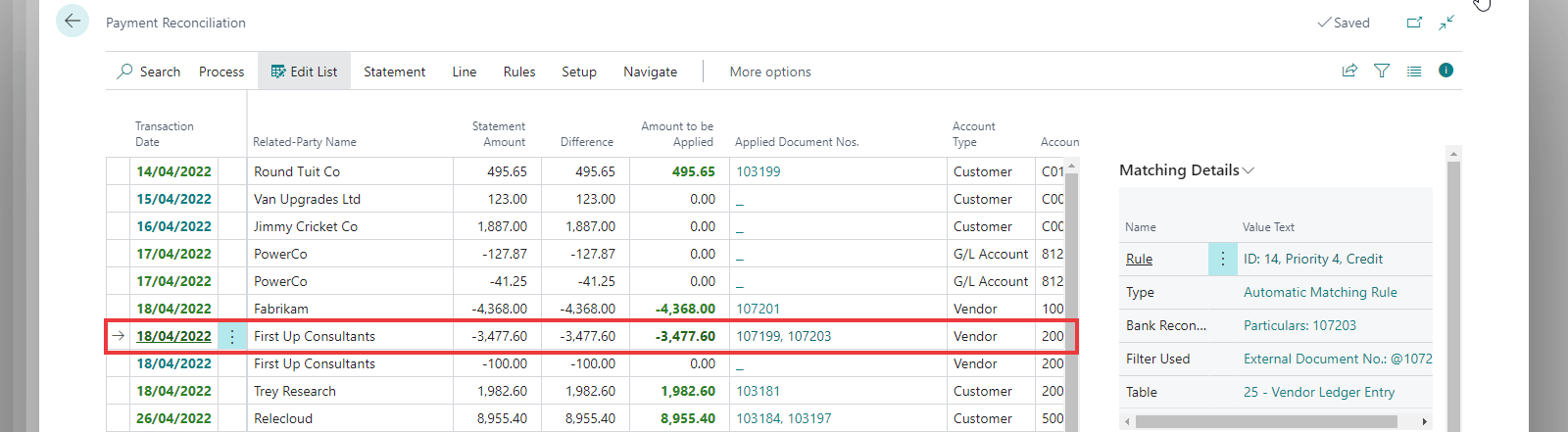

The Blue/StrongAccent shows we have a match that is not applied to an account type that can be applied. For Example, Vendor or Customer payments. You can see the rule used to match this line under the Matching Details.

The above shows the rule used to match is ID:1 being Automatic Rule with ID 1, which has been set with Priority 1, and only for Debit transactions.

Green/Favourable shows that you either have a match that is applied to an account type and can be applied in full, or a match that does not need to get applied. This includes General Ledger matches, e.g. Bank Fees.

Below you can see that the line is fully applied.

For customer and vendor transactions, there is the possibility that you allow for payment discounts or payment tolerances. The app considers this will trying to automatically apply entries. You have the following possible scenarios here:

- Green/Favourable indicates that the entries are fully applied to the amount when taking the payment discount into account and there are no differences. You will notice that where a payment discount is anticipated the applied amount will be higher than the statement amount. You can view the payment discount on the Line Details fact box.

- Yellow/Ambiguous indicates that the entries are fully applied to the amount when taking the Payment Discount but there is a difference within the tolerance limits on the applied entries. You can view the Maximum Payment Tolerance on the Line Details fact box.

- Red/Attention indicates that entries will be applied but transactions will not get fully applied when taking payment discounts and tolerances into account.

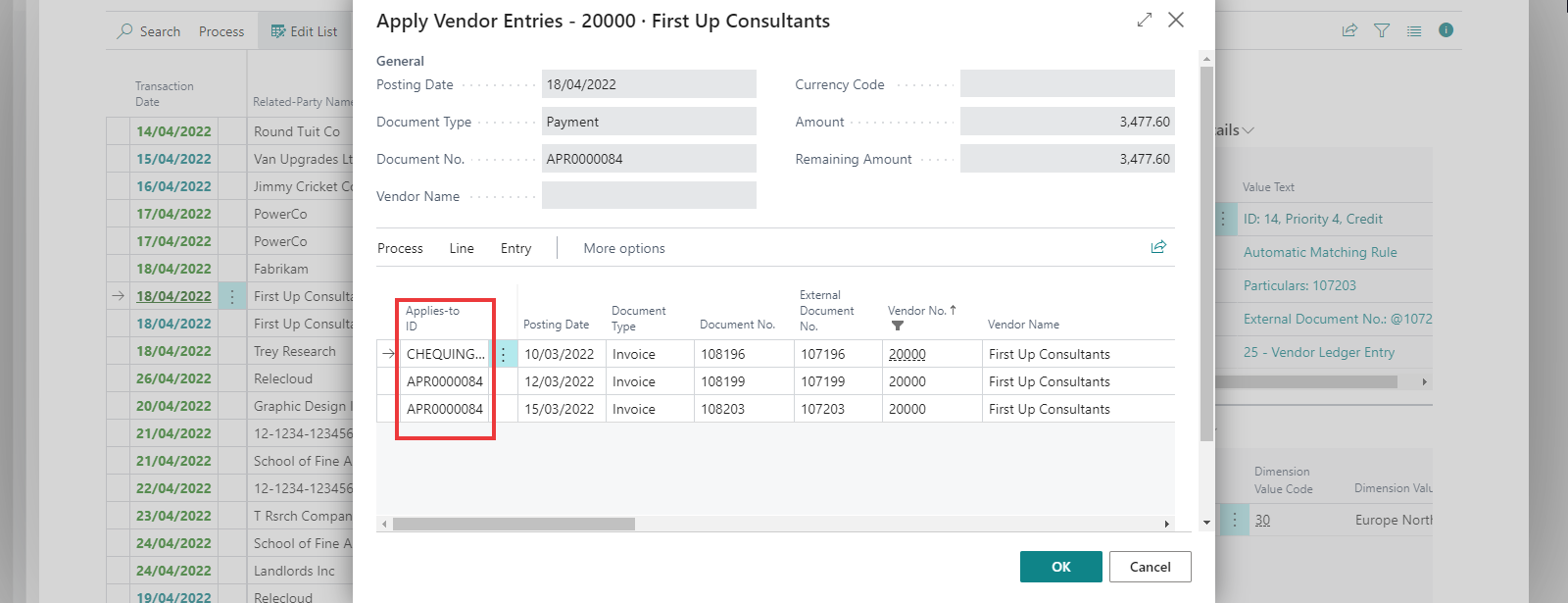

If you click on the value of the Applied Document Nos. you can manually update the application if required by adjusting the Applies-to ID field, as per standard Business Central.

Allocations

In many cases, you will receive a single line on the bank statement that must be processed into multiple accounts. Examples of this include:

- A receipt from one customer needs to be split into multiple accounts when a head office or holding company makes payment on behalf of related subsidiaries.

- A receipt from a customer needs to be offset against a vendor - this is where the customer is also a vendor and has deducted the balance from the payment they make to you.

- Transaction Fees charged by banks for certain transactions (e.g. for payments made in a foreign currency)

- Transaction Fees charged by payment service providers

- Foreign currency payments received into a local bank account (e.g. Customer pays USD into your local NZD account)

The Allocations feature provided with this app allows you to handle the all of the above scenarios without having to do manual journals. In the sections below we show you how to handle the various scenarios.

Receipts from Related Companies

It's common to work with multiple entities owned by the same holding company. These related entities often share internal services, such as centralised payment functions, where one entity makes payments on behalf of all others. In such cases, you may receive a payment into one company's account that needs to be reallocated to another. Typically, this would require a manual transaction. However, using the allocations feature, you can handle this while performing the bank reconciliation - saving time and eliminating the need for additional manual processing after reconciliation.

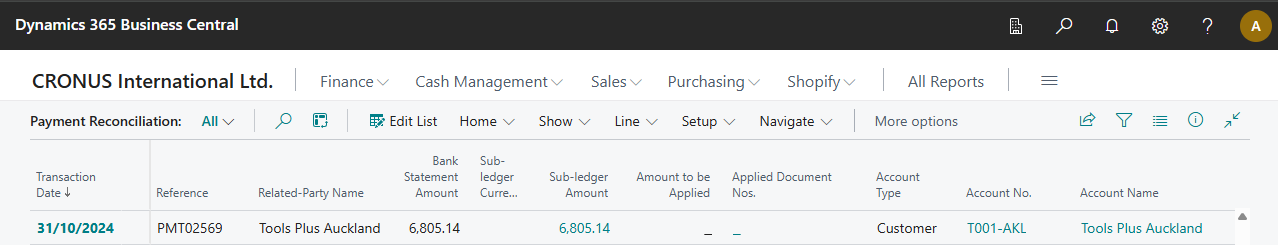

As you can see in the example bank statement below, Tools Plus Auckland has made a payment to us. The app has automatically assigned this payment to the Tools Plus Auckland customer account.

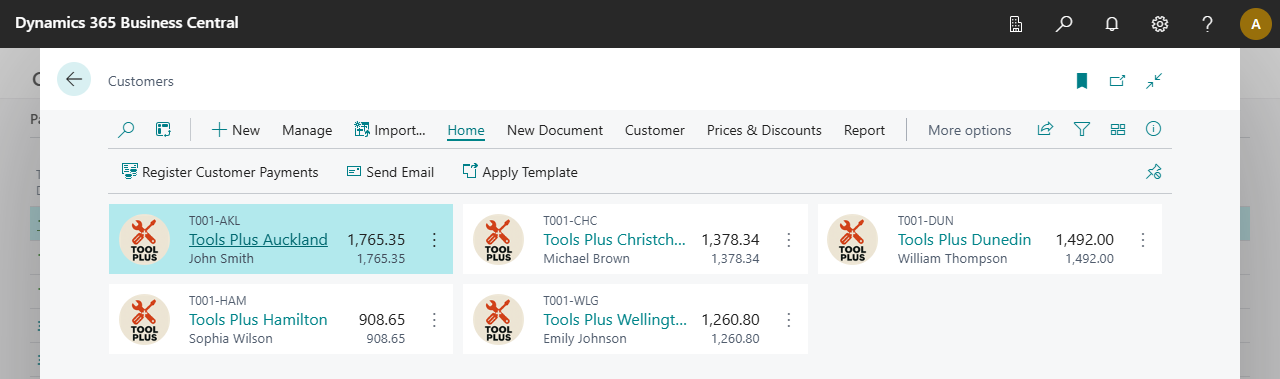

However, Tools Plus operates multiple accounts with us—one for each branch. Therefore, this payment needs to be split accordingly, as Tools Plus Auckland does not owe the full $6,800.

Since we have multiple customer accounts for ToolPlus and know that payments are processed from the Auckland branch, we can use the Allocations feature to distribute the payment across all relevant accounts.

In the animation below, you can see how this works:

- We open the Allocations page.

- We filter the customer list only to show ToolPlus accounts.

- We select all the relevant customers, and the app automatically adds them to the allocation lines.

- Next, we use the Applies-to function to select the specific invoices being paid. The amounts are automatically updated based on the selected invoices.

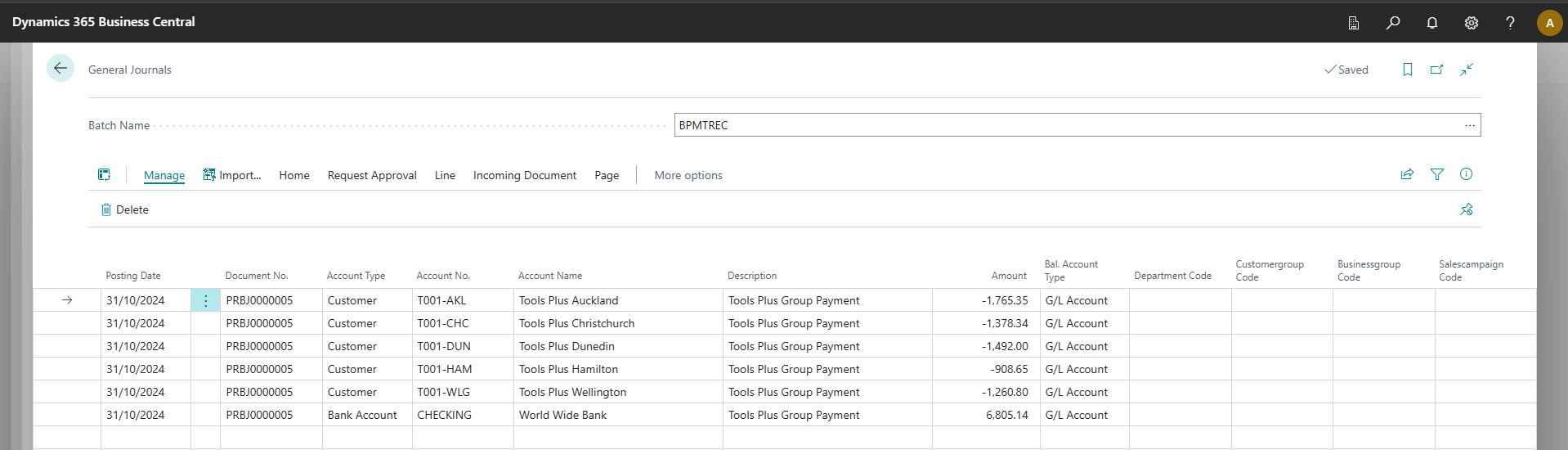

When you transfer to the journal, the app will create a line for each customer and one to the bank account:

Our Excel Imports app also allows you to transfer payments from one account to another while processing the remittance advice. Suppose the customer provides you with remittance advice. In that case, we recommend allowing the payment to be posted to the customer who paid you and not allocating the entries while doing bank reconciliation. This will remove the manual process of allocating the payment to invoices. You can read more about this here.

Transaction Fees

Some transactions may incur bank transaction fees. For example payment service providers like Stripe charge a fee for each transaction. As a result, the amounts received from the payment service provider will differ to the amounts paid by your customers. In these scenrios, manual processing is usually required because you want to credit the customers with the full amount they paid and expense the fee from the payment service provider. This can be a time-consuming process - especially when you have hundreds or thousands of transactions.

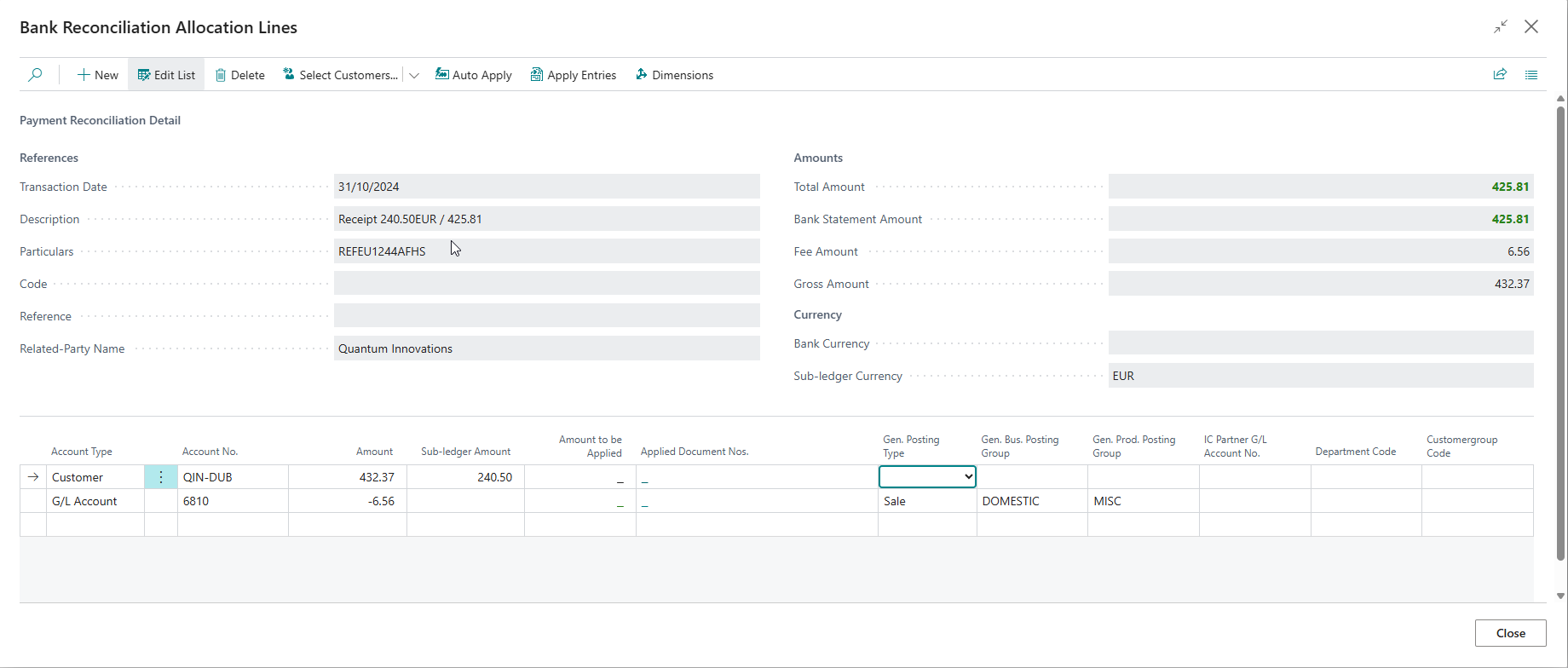

The Payment Reconciliation page includes a Fee Amount column. supports this scenario by:

- Crediting the customers with the full amount they paid

- Debiting the fees expense account with the fee charge

To process bank transaction fee, you first need to setup the Fee Account Type and Fee Account No on the Bank Account Card, which you can read about here. Once setup, you will be able to see an additional field: Fee Amount.

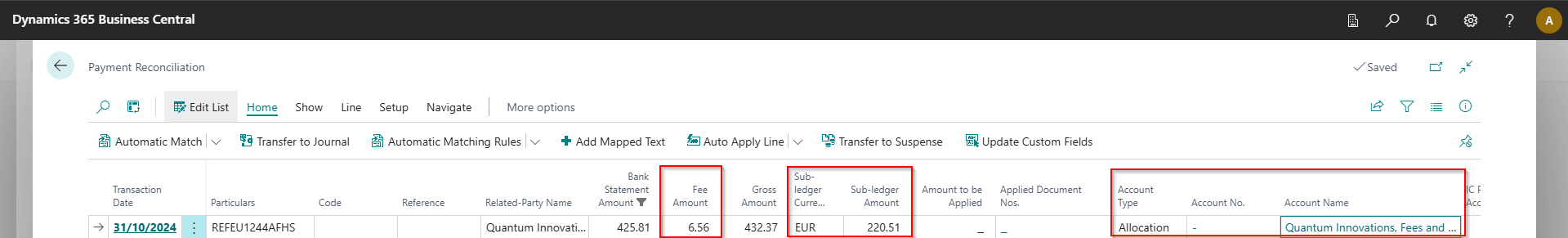

In the example below, we process a payment made in a foreign currency into our local bank account. The bank charges us a fee for this payment:

- Fill in the Fee Amount with the bank transaction fee. The Account Type will automatically changed to Allocation

In the above image, you will notice that in addition to the fee amount, we have specified the Sub-ledger Currency and Amount. This will allow us to post the foreign currency to the customer.

- You can drill down on the Account No. or the Account Name to see the details.

Transaction Fees - Payment Services Provider

Payment service providers like Stripe collect funds on your behalf and typically charge a fee for the service. They also provide you with a settlement statement detailing every transaction processed through their service, including the associated fees for each payment. Although these payment service providers are not bank accounts, Business Central's bank reconciliation feature is well-suited to handle this type of reconciliation. The app simplifies the process with its automatic match capability.

The animation below demonstrates an example using an imported Stripe settlement statement.

- As we opened the statement, all the statement lines were unmatched, and there were no open entries on the Stripe bank account.

- We opened the Payment Reconciliation page and used the automatic match feature to reconcile all lines.

- Since we used the Payment Intent ID from Stripe, the system could match each line accurately with no discrepancies.

- To verify, we used the Show actions to demonstrate that all lines were fully matched and applied.

- After verifying this, we transferred the lines to the journal and posted it automatically.

- We then returned to the bank statement and found that all the lines had matched.

- We then posted the bank statement.

Although we did not show this in the animation, we had separately posted the invoices against the cash sales customer, and the Stripe Payment Intent ID was used as a reference number. This is how the app could automatically match each transaction.

Transfer to Journal and Posting

When you have applied all your transaction lines, you can transfer the Payment Reconciliation lines to the defined General Journal Template and Batch for posting. You can do this by following the below steps:

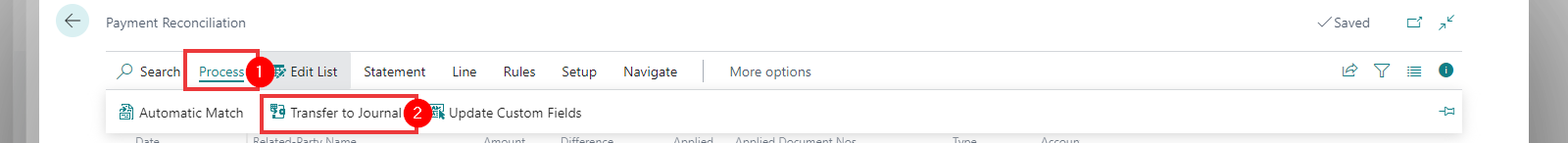

- On the Payment Reconciliation navigation menu, click on Process then Transfer to Journal.

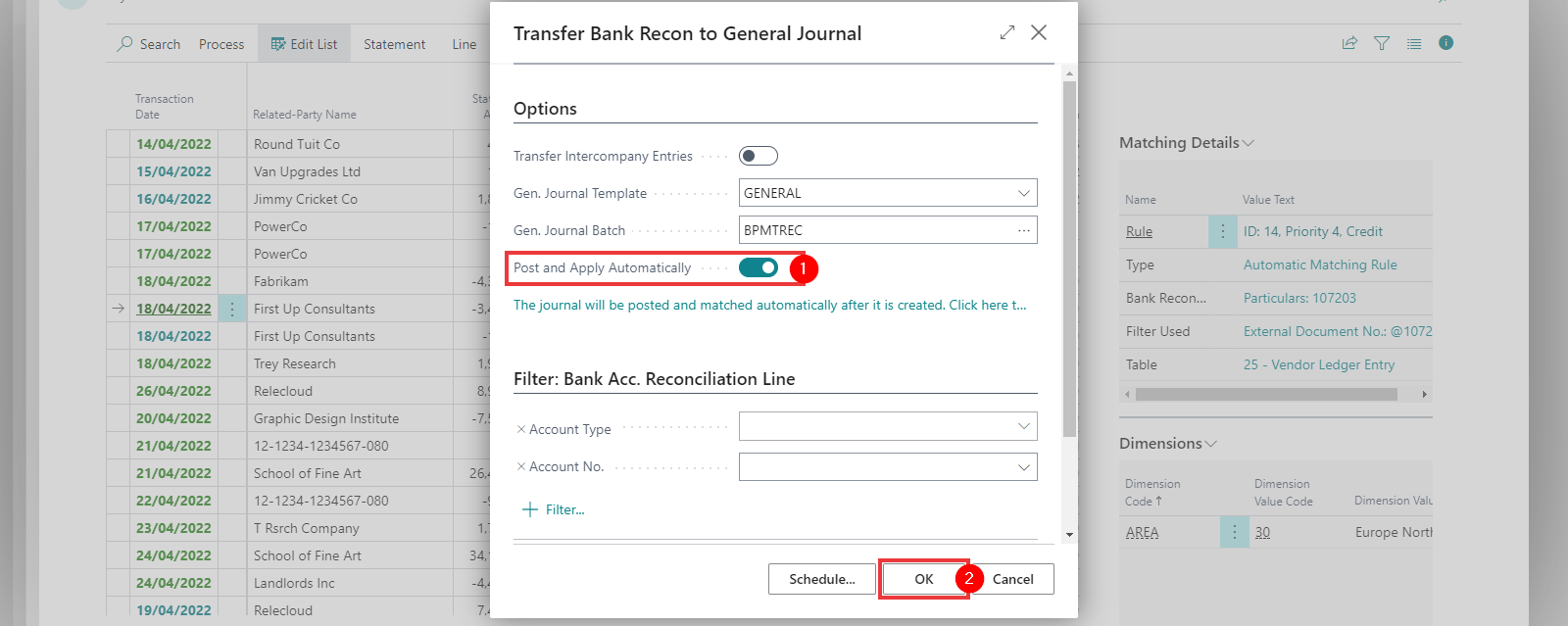

- Engage the Post and Apply Automatically to automatically post and apply the journal on creation. Click OK.

- All Payment Reconciliation lines are now posted if automatic posting was engaged. If not engaged, you will need to post the journals directly from the defined Journal Batch. Return back to the Bank Account Reconciliation page.

If you select the link The Journal will be posted and matched automatically after it is created. Click here... it will give you the option to update the default setting for automatic posting on the Payment Reconciliation Setup. You will still need to enable the Post and Apply Automatically toggle for your current journals to be posted automatically. The default settings will then apply to all future journals.

- You will now see the result of your Payment Reconciliation journal. If you had reconciled all lines, you can now complete the standard Business Central Bank Account Reconciliation.

Configure Journal Descriptions

The app will transfer the description of the bank reconciliation line to the journal by default. This description may contain many references and look untidy - especially if the description gets shown on outbound documents like your customer statement. The app provides a setup per bank account to allow you to configure how to default the description.

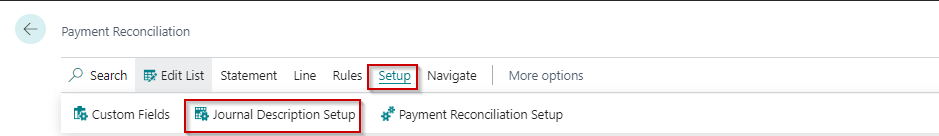

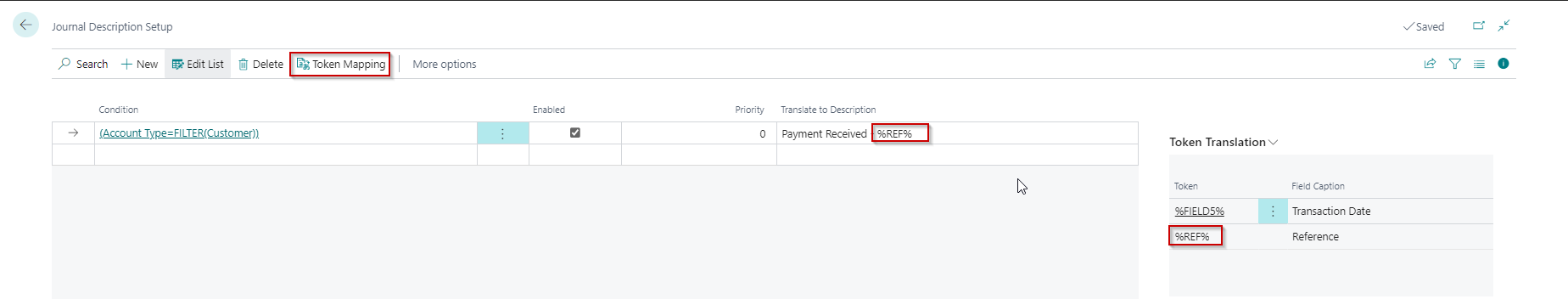

Journal Description Setup

This setup is available on the Payment Reconciliation, Bank Account List, and Bank Account Card pages.

On this page you can specify with conditions the descriptions that should get copied to the journal. The description can include fixed text and tokens that get replaced with field values from the bank reconciliation line.

| Field | Purpose |

|---|---|

| Condition | Specifies the conditions in which the description should get copied to the journal. |

| Enabled | Specifies that this rule is enabled. This value will default to yes, but you can turn it off if you do not want the rule used for any reason. |

| Priority | Specifies priority assigned to this rule. In a scenario where multiple rules are applicable, the rule with the lowest value in this field gets applied. |

| Translate to Description | Specifies the description that the app should copy to the journal. The field can include fixed text and tokens. Tokens get replaced with the values from the fields mapped to them in the Token Mapping. |

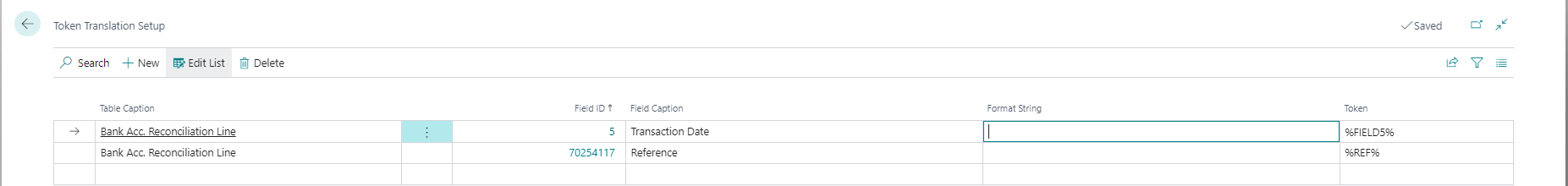

Token Mapping

Here you configure the tokens that you use in the Journal Description Setup.

| Field | Purpose |

|---|---|

| Table Caption | Specifies the caption of the table. |

| Field ID | Specifies field that you wish to use for this token. |

| Field Caption | Specifies the Field Caption. |

| Format String | Specifies a format string that can influence how values are formatted. Click here for more details on how to specify the format string. |

| Token | Specifies the token that gets used as a placeholder for the field. The token must start and end with % and usually have a meaningful name. For example, %REFERENCE% or %TRANS_DATE%. |